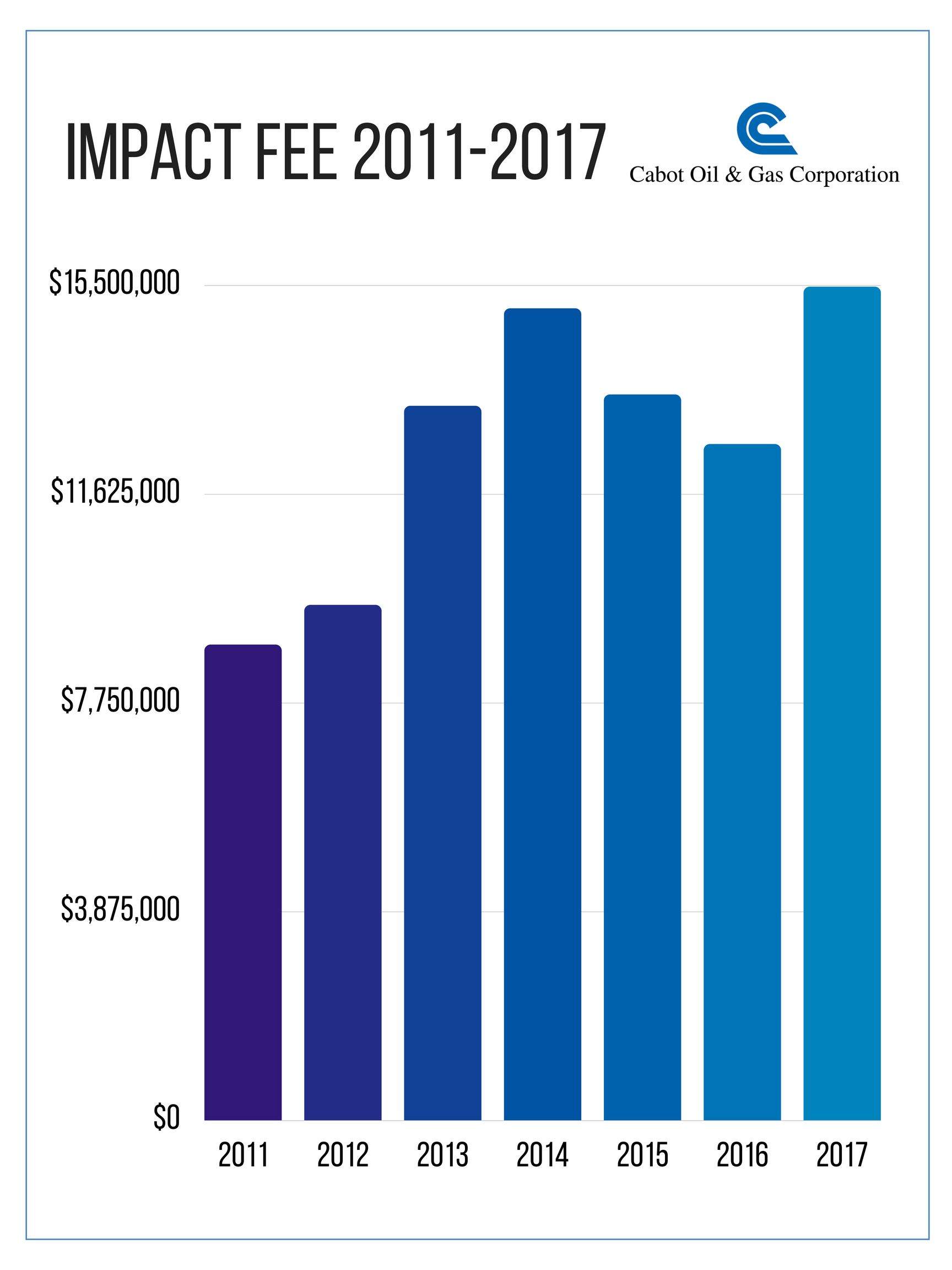

In August, Pennsylvania Public Utilities Commission (PUC) released the results of the Impact Fee in 2017, and they were astounding.

Last year, the Impact Fee totaled nearly $210 million, bringing the total over the past seven years to almost $1.5 billion. Cabot Oil & Gas Corporation contributed around $15.5 million alone in 2017, bringing our total contributions to over $88 million.

The Impact Fee, also known as Act 13 or the impact tax, requires natural gas producers to pay a fee for each well drilled. The money is distributed back to local and state governments to benefit communities.

“The local side of this tax is important,” Cabot Director of External Affairs George Stark said during a radio interview the day after the results were released. “When the counties get those dollars, they’re making decisions on what has changed. What has the impact been locally? Do they need to have a wider road? Are the community needs being met? School districts will see those dollars, the county will see those taxes.”

For example, according to the county and municipality fee spending breakdowns from PUC, the most money went into capital reserve funds, emergency preparedness and public safety, and public infrastructure construction in 2016.

Gary Sutton, a host on NewsTalk 93.9 & 910 WSBA, asked Stark about state and federal policies that affect the natural gas industry both positively and negatively. Stark noted that while the Impact Fee has had a massive positive effect for local communities in Pennsylvania, other proposed fees would not.

Sutton asked, “What is the difference between the Impact Fee and the Severance Tax, from your particular interpretation of it?”

“The most particular answer is, where does the money go? Does it go to Harrisburg or does it go to Bradford?” Stark said, honing in on the idea that the impact tax allows a larger, positive impact on the local communities that are participating in the production of natural gas rather than statewide, which could include places already thriving from other industries like Philadelphia and Pittsburgh.

“ didn’t have a lot going for them, but now they have it. Let’s allow them to benefit locally,” Stark said.

Stark also debunked a common statement that Pennsylvania is one of the only state without a severance tax: “To say that we’re the only state in the union without a severance tax is really a choice on words. We have an impact tax.”

To add some perspective, in 2016 the Impact Fee brought in more revenue than severance tax collections in Ohio, West Virginia, Colorado, and Arkansas combined.

Industry expert Tom Pyle, the president of the Institute for Energy Research and served at the head of President Donald Trump’s Department of Energy transition team, was in Pennsylvania the same week the Impact Fee results were released. In a Penn Live article, Pyle mentioned the need for appropriate policies in Pennsylvania to continue the successful production of natural gas resources in the Commonwealth.

“Pennsylvania gas producers already pay an impact fee that allocates revenue to every county in the Commonwealth, particularly to counties and municipalities where unconventional natural gas development is occurring,” Pyle writes. “With the right policies in place, Pennsylvania’s natural gas producers can continue to provide good-paying jobs for families and steady revenue for local communities.”

“Pennsylvania’s natural gas helps meet our domestic energy needs at home and increasingly around the world,” Pyle writes.

Pennsylvania’s natural gas production is increasing, allowing resources to be shipped across the world, while local benefits of the Impact Fee continue to grow here in the Commonwealth.