It took nearly 70 years, but the United States is once again a net exporter of energy. Natural gas from Pennsylvania is a big part of the equation, helping to bolster “energy security” and regional “energy independence.”

“Being a net exporter has a significant impact on both the US economy and US foreign policy,” said Kenny Stein, director of policy for the Institute for Energy Research. “Since at least the 1970s, a huge percentage of US foreign policy decisions have revolved around access to energy supplies, especially oil. Wars and other conflicts around the world that the US might previously have felt a need to intervene in for energy supply reasons no longer seem necessary.”

While consumption of energy in America has remained fairly steady since 2000, production of natural gas has steadily increased since 2006 and domestic crude since 2008. In 2019, production exceeded demand for the first time since 1956. Foreign nations have taken advantage of both the easing of restrictions on crude exports in 2015 and a dramatic increase in the availability of liquefied natural gas (LNG).

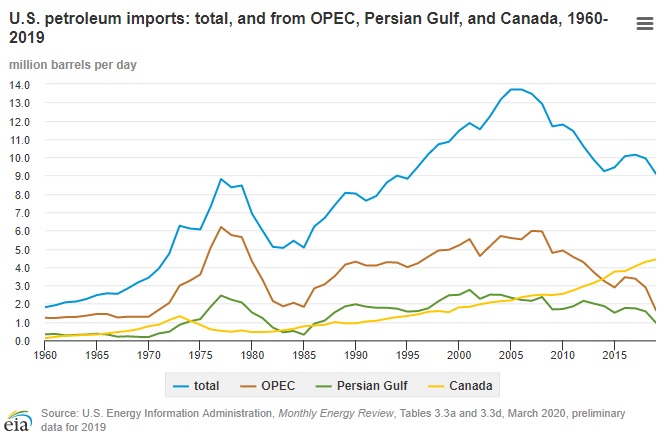

Crude oil still accounts for the largest share of US energy imports, and we were still importing more crude oil than we were exporting in 2019, according to the U.S. Energy Information Administration. But imports have taken a dramatic drop from a peak in 2006. Natural gas exports and imports met in the middle in 2017, an exports eclipsed imports in 2019. We have always been a net exporter of coal, which is a small but important part of the overall mix.

So, could this set the stage for the US eventually reaching “energy independence,” a term tossed around a lot in the past few years? According to Kenny, we have essentially already achieved energy dependence in North American, considering that the majority of what we import comes from Canada and Mexico. But because oil is a global commodity and its value is determined internationally, we will always be tethered to the global market. But the ties are not as binding.

In the Gulf coast and Texas, Kenny explains, the US exerts control over a portion of its share of the oil market in several ways. “Gulf coast refineries are tuned to refine heavier grades of crude, so Canadian oil is used, and light oil from west Texas ends up exported,” Kenny noted. “Crude from Canada and Mexico is often cheaper than the price that Permian crude can fetch for export so, for the overall economy, it is better to buy and import the cheap oil and export the pricey oil.”

Kenny prefers the term “energy security” and points to Pennsylvania’s growing role due to the abundance of natural gas and our proximity to midwest and eastern markets. Though the state is still one of the leading producers of coal, it is the development of the Marcellus shale – and especially technological advances in the past 10 years – that has put the Commonwealth back on the map. Second in natural gas production only to Texas, Pennsylvania’s gas meets a huge percentage of domestic needs and retains its value without being exported. “Excess gas produced in Texas would have been piped to the eastern half of the US,” said Kenny. “That gas is no longer needed domestically, so ends up being exported instead.”